구글아이디를 보유한 사람이라면 누구나 구글 문서 서비스를 활용하여 문서를 작성하고 공유할 수 있습니다. 구글 문서는 온라인 상에서 워드프로세서와 유사한 기능을 제공하여 효율적인 문서 작성을 도와줍니다. 뿐만 아니라 다수의 사용자가 동시에 문서를 편집하고 공유할 수 있는 협업 기능도 제공하여 팀 프로젝트나 그룹 작업에 이상적입니다. 이 글에서는 구글 아이디를 이용하여 구글 문서를 활용하는 방법에 대해 자세히 알아보겠습니다.

1. 구글 문서에 접속하기

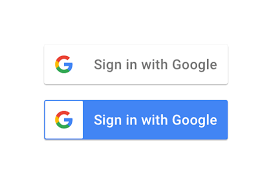

구글아이디로 문서 서비스에 접속하여 문서를 작성하고 편집할 수 있습니다. 또한 구글 계정으로 로그인하여 사용할 수 있습니다.

2. 새 문서 작성하기

문서를 작성할 때에는 텍스트 입력뿐만 아니라 이미지나 표 등 다양한 형식의 콘텐츠를 삽입할 수 있습니다. 또한 글꼴, 크기, 색상 등을 조절할 수 있습니다.

3. 문서 편집하기

구글아이디를 통해 문서를 작성하려면 단순히 텍스트를 입력하는 것만으로 충분합니다. 마우스를 클릭하여 원하는 위치에 커서를 두고 텍스트를 입력할 수 있습니다.

4. 문서 저장하기

작성한 문서는 자동 저장되므로 따로 저장할 필요가 없습니다. 필요한 경우에는 문서를 다운로드하여 컴퓨터에 저장할 수 있습니다

5. 문서 공유하기

구글아이디로 문서를 공유할 때에는 공유하고자 하는 사람들의 이메일 주소를 입력하거나 링크를 생성하여 공유할 수 있습니다. 공유된 문서에는 편집 권한을 부여할 수 있습니다.

6. 협업 기능 활용하기

구글아이디는 다수의 사용자가 동시에 문서를 편집할 수 있는 협업 기능을 제공합니다. 이를 통해 팀 프로젝트나 공동 작업을 효율적으로 진행할 수 있습니다.